Predictable Pipeline Part 2: Metrics and the Stack

Douglas JohnsonManaging Director

Douglas JohnsonManaging Director

Doug Johnson is Founder and Managing Director of ScaleUp, a firm that helps early-stage teams execute sales operations, produce actionable data, grow top-line revenue and implement sales as a permanent, high-expertise discipline within their companies.

In this 3-part series, Doug walks us through a workshop that he’s delivered to hundreds of early-stage companies and their sales teams to help build predictable pipeline and repeatable closing processes that target your most profitable market segments, driving you towards an increased valuation and de-risked growth strategy.

If you’re interested in doing the activities in the video, you can access the spreadsheet here.

Metrics: Managing According to Leading Indicators

Confidence in Your Forecast

The importance of leading and lagging indicators allows for connections to be made over time. If you adhere to a set of prospecting and sales stages consistently, you develop more and more confidence in the probability that it advances between stages. It all stems from adhering consistently to the stages you define and the metrics you attribute to each stage.

Team Efficiency

You’re also then able to coach individuals in their weaker areas. If you have multiple sales people, you’re able to then help individuals in their weaker area because you know how each person relative to each other is performing in those stages. You might know different industries that are progressing through the stages at a lower rate. So you’re not going to spend your resources, your capital, your time in those areas.

Leading Indicators and Dependent Variables

Collecting and splicing data around leading indicators and dependent variables helps you map out, of the industries that you can serve, which ones have a higher prospecting velocity ($ over time). Unless prioritizing a specific industry with low velocity is strategic in nature, this allows you to stop spending time and effort on a market segment that is low value for your business and vice versa. This works for whichever variable you choose to look at.

Examples of leading indicators that you want to track:

- The # of New Prospects Daily

- The # of Engaged Prospects Weekly

- The # of Opportunities Created Weekly

- The Average Size of Companies a Particular Prospecting Cycle

- The Amount of Time it takes to get through a Prospecting Cycle

Examples of dependent variables for each prospect that you want to track inside your CRM:

- The Lead Source

- The SDR

- The AE

- The ‘Created’ Date

- The Prospect’s Product

Tracking Objections

If you have the ability to track it in your CRM, track the types of objections you get. The objection type you’re getting is going to help in terms of measuring the effectiveness of your early-stage prospecting efforts.

If you’re not an experienced sales person, you probably aren’t great at prospecting yet, which means that if you’re mindful that it’s one of the areas that you can improve the most, tracking the objections or recording the calls helps you get much better at it.

Sales Stack: Cutting Through the Noise of Tools

If you’ve worked in an organization, whether big or small, you’d know that the sales stack can get quite noisy. As companies grow and evolve, it unlocks capital to purchase new tools. But is it always necessary? You should be thinking of tools in terms of the value and impact to the business.

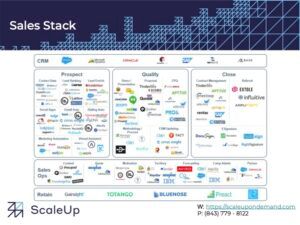

This is one of the common market landscape maps you might see. There’s hundreds and thousands of tools. But there’s only a handful that are important to you at an early stage and they almost all tend to focus on prospecting because you’re not at a point where you need tools to help with processing of proposals and demonstrations.

Questions to Ask:

- What are your thoughts on budget?

- What are the steps in your sales cycle?

- How many people internally do you expect to interact with your customers within 12-24 months? How many transactions do you expect to close and how much revenue will renew over the next twelve months?

- What do you have in place today? Are people using them? Who do you have in mind to manage this stack, what is their experience in managing and implementing sales tools?

- Who is your final decision maker? What are some of the market segments you focus on?

- Are you predominantly an inbound or an outbound driven sales team?

- What are the KPIs that your sales stack should track?

The Combination

There’s no one-size-fits-all perfect sales stack. But there’s a combination of tools that I recommend to probably 95% of all people who attend this workshop.

1. CRM

You can choose from HubSpot, Freshworks or Pipedrive. You might contemplate Salesforce but it’s probably too robust for the large majority of early-stage teams. When you get to the point where you have four or more salespeople, it might make sense. But for those of you who’ll only have 3 or less salespeople for 2-3 years, HubSpot, FreshWorks, or Pipedrive are all great.

2. Sales Automation

This is a tool that allows you to create leverage and reach more people more consistently. You might have three different roles that you’re trying to communicate within a prospect, but each of those gets a different cadence, meaning a different number of touches.

Whether you’re communicating via LinkedIn or email or phone, HubSpot, Freshworks, Pipedrive, and Outreach can prescribe and keep you on track. So you don’t have to mentally remember who you’re speaking to next. They’re basically generating a task list for you. It can do A/B messaging on subject lines and the body of the content.

3. Virtual Assistant

In having one of the tools above, you’re able to introduce a virtual assistant to take a lot of the tasks that are repetitive and aren’t high value for you to do. You can use sales automation as a way to define what that cadence is and introduce a virtual assistant. I recommend Upwork.

4. Prospecting

The LinkedIn Sales Navigator extends the medium and channel in which you could reach someone so if LinkedIn is a place where your prospects are residing, LinkedIn sales navigator gets you access to them in another way.

5. Data Source

Data sources help find contact information, whether it’s phone or email. Lucia and RocketReach are both suitable.

Cost per Head

When you think about packaging this all together, it’ll probably cost about $300 per person per month. It may seem steep but the value you get out of it is more than just $300. It frees you from the manual work and builds more opportunities for you to be able to discuss the product with prospects.

Ready for more? In part 3, Doug walks us through a framework for you to understand how you can improve the strength of your messaging versus just guessing at it.

Subscribe to Heavybit Updates

You don’t have to build on your own. We help you stay ahead with the hottest resources, latest product updates, and top job opportunities from the community. Don’t miss out—subscribe now.

Content from the Library

Predictable Pipeline Part 3: Messaging Strategy

Doug Johnson is Founder and Managing Director of ScaleUp, a firm that helps early-stage teams execute sales operations, produce...

Generationship Ep. #24, Nudge with Jacqueline-Amadea Pely and Desiree-Jessica Pely, PhD

In episode 24 of Generationship, Rachel Chalmers speaks with Dr. Desiree-Jessica Pely and Jacqueline-Amadea Pely, co-founders of...

Generationship Ep. #14, Goosebumps with Walter Roth of Simple Lens

In episode 14 Generationship, Rachel welcomes Walter Roth, a distinguished sales coach and mentor. Walter discusses the...